Risk Parameters

Each asset within the Goledo Protocol has specific values related to their risk, which influences how they are supplied and borrowed within the protocol.

It is crucial for Goledo community to understand the underlying risk of each asset: assess the smart contracts security, understand the risks of centralization and market risks.

Risk Parameters Analysis

The risk parameters mitigate the market risks of the assets supported by Goledo. Each borrow is based on an over-collateralization with a different asset that may, be subject to volatility. Sufficient margin and incentives are needed for the position to remain collateralized in the event of adverse market conditions. If the value of the collateral falls bellow a predetermined threshold, a portion of it will be auctioned as a LIQUIDATION_BONUS to repay a portion of the debt position and keep the ongoing borrow collateralized.

Market risks can be mitigated through Goledo's risk parameters, which define collateralization and liquidation rules.

These parameters are calibrated on a per asset basis to account for the specific risks identified.

Loan to Value

The Loan to Value (”LTV”) ratio defines the maximum amount of assets that can be borrowed with a specific collateral. It is expressed as a percentage (e.g., at LTV=75%, for every 1 CFX worth of collateral, borrowers will be able to borrow 0.75 CFX worth of the corresponding currency). Once a borrow occurs, the LTV evolves with market conditions.

Liquidation Threshold

The liquidation threshold is the percentage at which a position is defined as undercollateralized. For example, a Liquidation threshold of 80% means that if the value rises above 80% of the collateral, the position is undercollateralized and could be liquidated.

The delta between the LTV and the Liquidation Threshold is a safety mechanism in place for borrowers.

For each wallet, the Liquidation Threshold is calculate as the weighted average of the Liquidation Thresholds of the collateral assets and their value:

Liquidation Penalty

The liquidation penalty is a fee rendered on the price of assets of the collateral when liquidators purchase it as part of the liquidation of a loan that has passed the liquidation threshold.

Liquidation Factor

The liquidation factor directs a share of the liquidation penalty to a collector contract from the ecosystem treasury.

Health Factor

For each wallet, these risks parameters enable the calculation of the health factor:

When the position may be liquidated to maintain solvency as described in the diagram below.

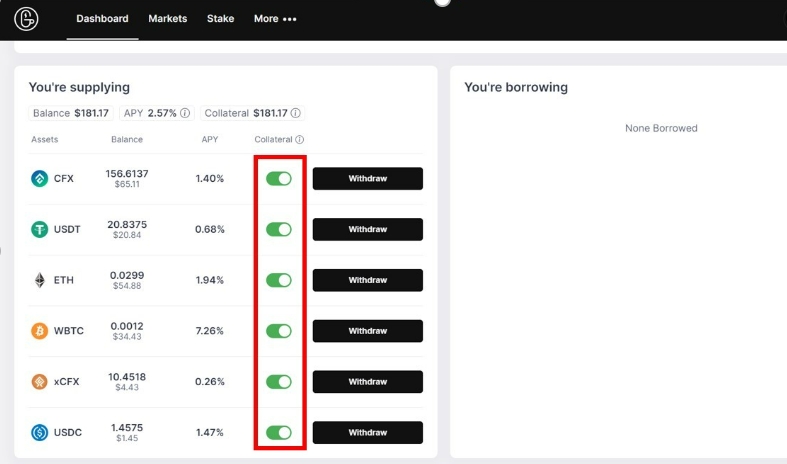

Collateral

Collateral in the case of Goledo is the tokens you deposit in exchange for taking out a loan. Collateral is given in exchange for your outstanding loan. This occurs if you cannot keep your health factor above one.

Another example of this would be a car loan. The car itself is the collateral in the loan. If you do not make your payments, the lender can take the car in exchange for ending the loan.

You can select which tokens you want to be used as collateral by using the toggle switch next to each token

Last updated